Competitiveness higher economic growth and improved quality of life for all taxpayers. Where do our federal tax dollars go.

Montana Budget Policy Center

Montana Budget Policy Center

Contributions for payroll taxes and the federal corporate income tax are added to place cash on a pre tax basis.

Federal Taxes And Families Policies And Analyses Epub Download. Taxpayers are grouped into brackets based on income. But federal fiscal policy still imposes a significant burden on the middle class and especially. As policymakers and citizens weigh key decisions about revenues and expenditures it is instructive to examine what the government does with the money it collects.

Federal corporate income tax are added to place cash on a pre tax basis. Taxes and the family. For the individual income tax the aggregate tax amount is allocated based on family income.

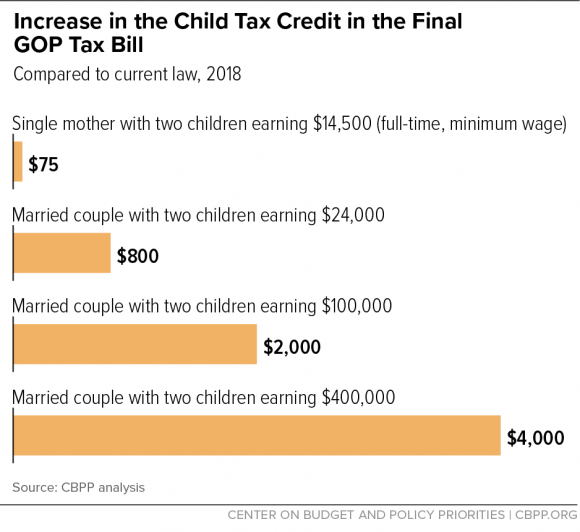

The mission of our federal program is to promote tax and fiscal policy that leads to greater us. Crandall hollick the child tax credit. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

The taxes included are individual and corporate income payroll social security medicare and unemployment excises customs duties and. State and federal policy reform policy analysis partnerships and advocacy efforts to strengthen decision makers capacity to help kids and families through smart policies and system reforms. Gravelle the child tax credit.

Those who earn more are taxed at higher rates. Ever since the imposition of the federal income tax in 1913 the united states has had a system of marginal tax rates. Current law and legislative history margot l.

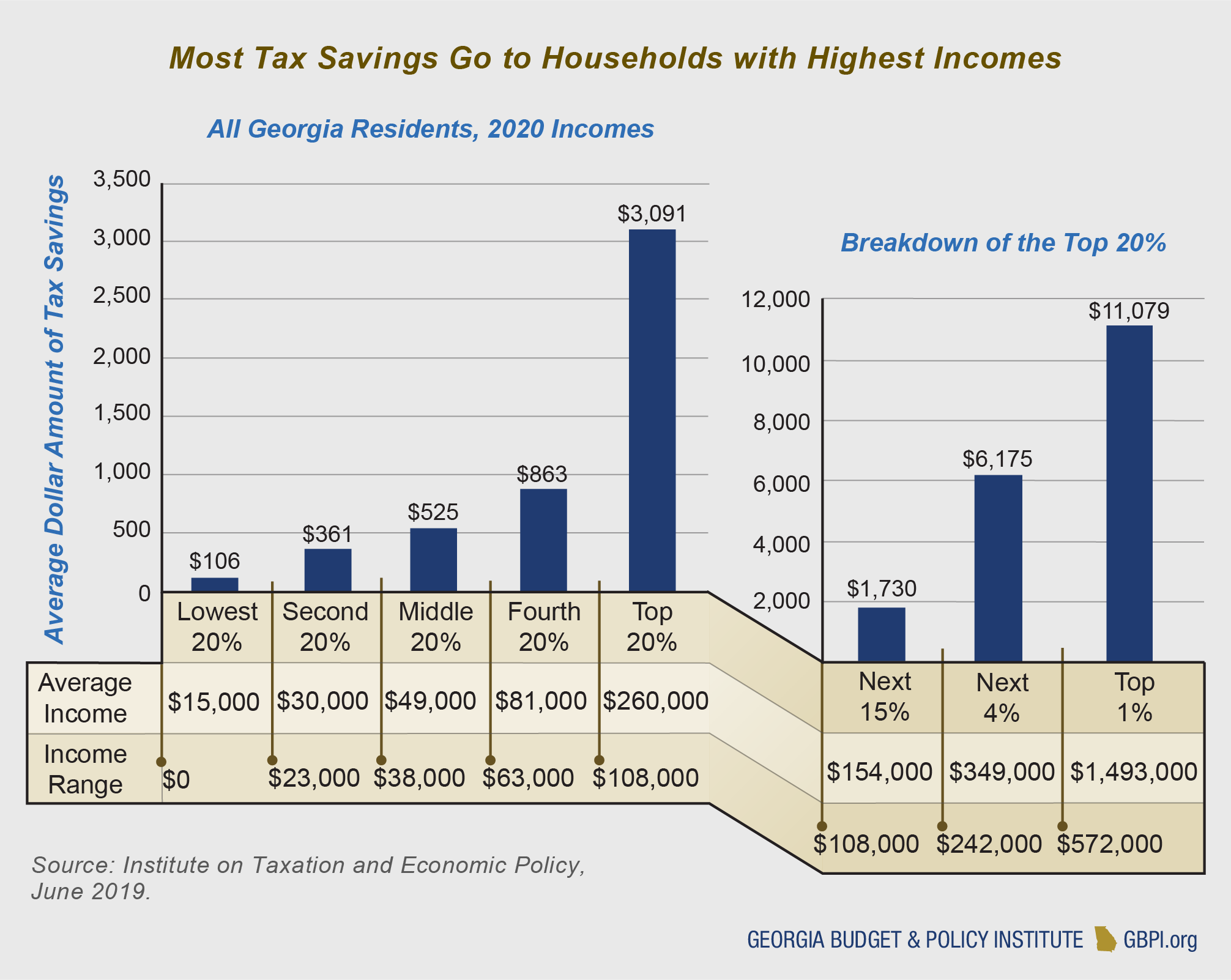

For most major federal taxes this studys method of allocation follows those of existing respected distributional analyses such as those done by the congressional budget office the joint committee on taxation and the urban brookings tax policy center. State advocates policymakers and media often use our work to inform public discourse on current and proposed tax policies. The federal government collects taxes to finance various public services.

The tax foundations center for federal tax policy produces timely and high quality data research and analysis on federal tax issues that influences the debate toward economically principled policies. Whether its at the state or federal level itep produces careful research and in depth analyses of tax policies and provides a voice for working people in tax policy debates. Crandall hollick dependent care.

Economic analysis and policy options margot l. The tax foundation is the nations leading independent tax policy nonprofit. Federal income tax treatment of the family jane g.

Current tax benefits and legislative issues christine scott and janemarie mulvey. Families are placed into deciles based on cash income adjusted for family size by dividing income by the square root of family size. Families are placed into deciles based on cash income adjusted for family size by dividing income by the square root of family size.

An Earned Income Tax Credit For North Carolina Is Just

An Earned Income Tax Credit For North Carolina Is Just

How Does The Earned Income Tax Credit Affect Poor Families

How Does The Earned Income Tax Credit Affect Poor Families

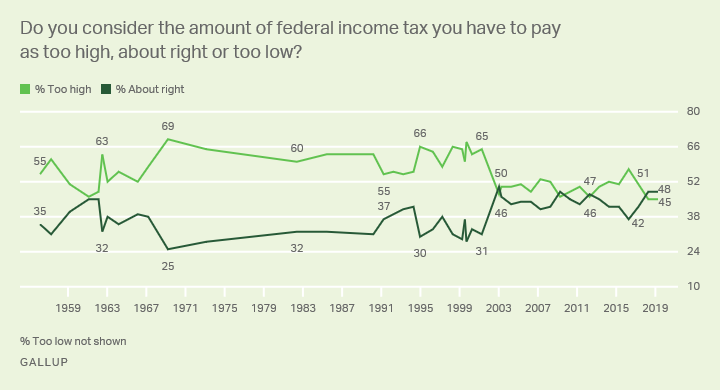

Taxes Gallup Historical Trends

Taxes Gallup Historical Trends

Analysis 70 Of Nm Families With Children Will See State

Analysis 70 Of Nm Families With Children Will See State

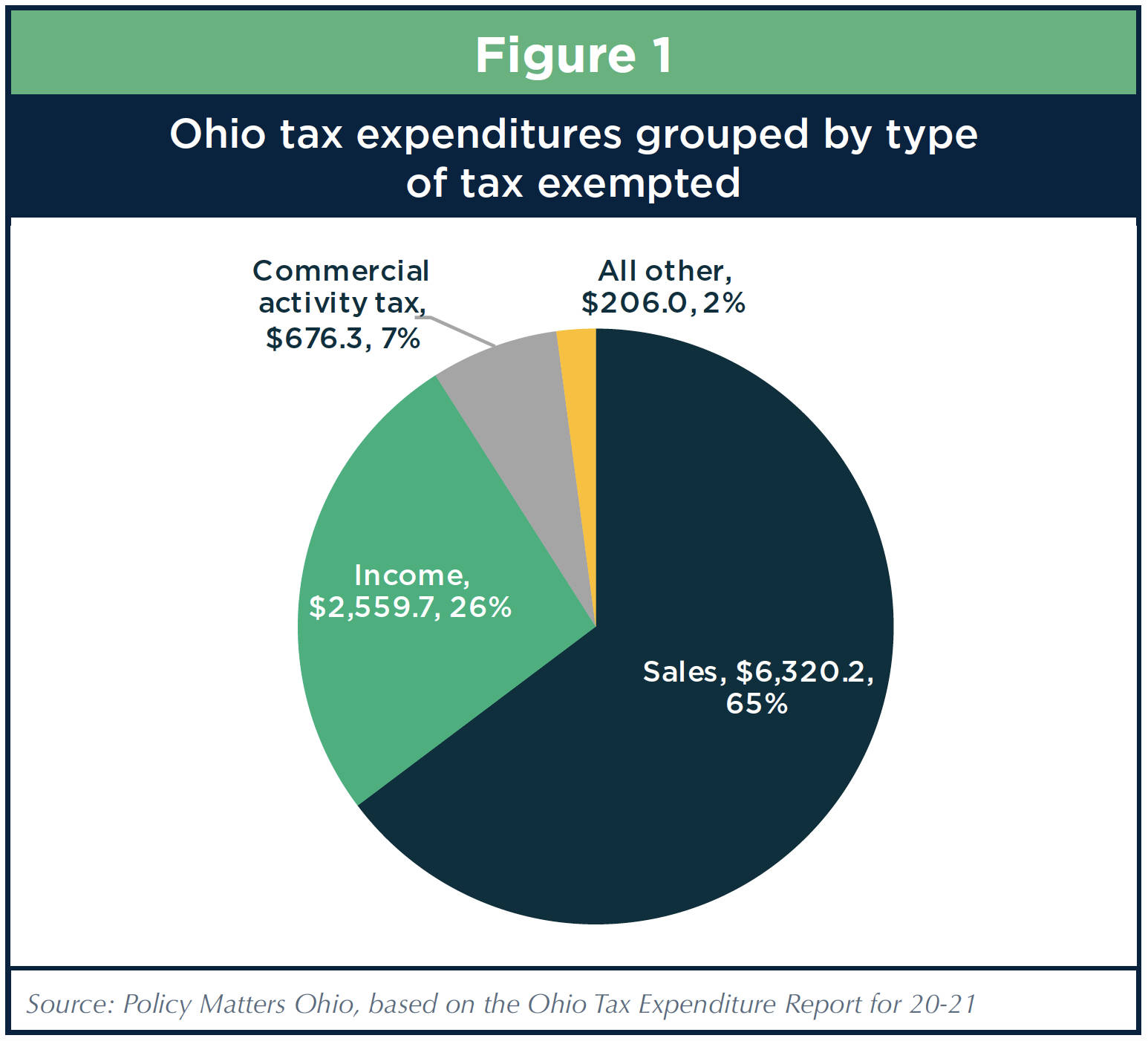

Ohios Ballooning Tax Breaks

Ohios Ballooning Tax Breaks

Analysis Of The Cost Of Living Refund Act Of 2019 Tax

Analysis Of The Cost Of Living Refund Act Of 2019 Tax

Taxation Our World In Data

Do Jobs In Your Texas Community Pay Enough Cppp Blog

California And Federal Dollars A Two Way Street

California And Federal Dollars A Two Way Street

/GettyImages-1126146268-d7b45a61d3964d3f9313d849cacdbc89.jpg) Understanding Republicans Vs Democrats On Taxes

Understanding Republicans Vs Democrats On Taxes

Analysis Of The Tax Cuts And Jobs Act Tax Policy Center

Analysis Of The Tax Cuts And Jobs Act Tax Policy Center

Taxes Just Facts

Analysis Of The Tax Cuts And Jobs Act Tax Policy Center

Analysis Of The Tax Cuts And Jobs Act Tax Policy Center

Who Pays 6th Edition Itep